Research report: Private Equity's role on Infrastructure Investment.Survey

Date

August 24, 2010

Subscribe to our newsletter and get the latest news and business opportunities in your inbox

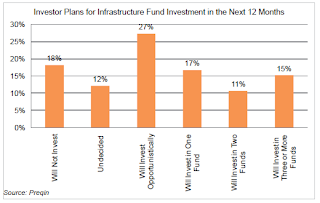

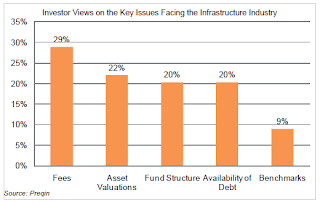

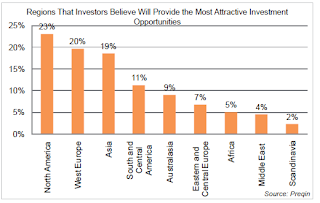

Did you know the website Preqin.com? It's kind of new (at least to me) but I think they are doing a good job.They have released a research report about the role of Private Equity on infrastructure investment. For that they have conducted a survey between private equity fund managers.Let me paste here the four conclusions I liked the most. They are as follows:1. Investor Views on the Long-Term Viability of the Private Equity Fund Model for Infrastructure InvestmentOver 50% of investors surveyed believe that the private equity model will still be utilized going forward, although this is dependent on the resolution of other issues already raised such as fund structures and fees. Of those investors that believe the private equity fund structure will not be used in the future, almost half think that it will be replaced by direct investment, although this is will limit the level of exposure smaller investors are able to gain to infrastructure assets.2. Investor Plans for Infrastructure Fund Investment in the Next 12 Months70% of investors surveyed plan to invest in infrastructure funds in the coming 12 months. This is compared to just 40% of investors that stated they planned to make investments in infrastructure funds in our October 2009 survey, and shows that investor confi dence is slowly returning following the financial crisis, with many investors looking to increase their exposure in the coming 12 months.3. Investor Views on the Key Issues Facing the Infrastructure IndustryThe highest proportion of surveyed investors (29%) are most concerned about fees, although fund structure, asset valuations and the availability of debt were each highlighted as important issues that need to be resolved. According to investors, the least pressing issue within the industry is performance benchmarks, with only 9% of respondents rating this as a key issue. This issue is relatively unavoidable due to the relative youth of the unlisted infrastructure market.4. Regions That Investors Believe Will Provide the Most Attractive Investment OpportunitiesUnsurprisingly, the developed North American and West European markets were highlighted as important regions. North America is slowly becoming more open to private sector involvement in infrastructure projects, with many investors intending to target such opportunities in the future. Asia was also a popular choice, with 19% of respondents highlighting the importance of Asian infrastructure development. This shows the increasing signifi cance of emerging market infrastructure as the need for development in these regions grows, which is also refl ected in the signifi cant number of Asia and Rest of World funds currently raising capital.Remember that you can find this research report and many others in the INFRASTRUCTURE/PPP REPORTS DATABASE and don't forget to visit the PPP BOOKSTORE.Follow me on twitter.Have a good day!

Did you know the website Preqin.com? It's kind of new (at least to me) but I think they are doing a good job.They have released a research report about the role of Private Equity on infrastructure investment. For that they have conducted a survey between private equity fund managers.Let me paste here the four conclusions I liked the most. They are as follows:1. Investor Views on the Long-Term Viability of the Private Equity Fund Model for Infrastructure InvestmentOver 50% of investors surveyed believe that the private equity model will still be utilized going forward, although this is dependent on the resolution of other issues already raised such as fund structures and fees. Of those investors that believe the private equity fund structure will not be used in the future, almost half think that it will be replaced by direct investment, although this is will limit the level of exposure smaller investors are able to gain to infrastructure assets.2. Investor Plans for Infrastructure Fund Investment in the Next 12 Months70% of investors surveyed plan to invest in infrastructure funds in the coming 12 months. This is compared to just 40% of investors that stated they planned to make investments in infrastructure funds in our October 2009 survey, and shows that investor confi dence is slowly returning following the financial crisis, with many investors looking to increase their exposure in the coming 12 months.3. Investor Views on the Key Issues Facing the Infrastructure IndustryThe highest proportion of surveyed investors (29%) are most concerned about fees, although fund structure, asset valuations and the availability of debt were each highlighted as important issues that need to be resolved. According to investors, the least pressing issue within the industry is performance benchmarks, with only 9% of respondents rating this as a key issue. This issue is relatively unavoidable due to the relative youth of the unlisted infrastructure market.4. Regions That Investors Believe Will Provide the Most Attractive Investment OpportunitiesUnsurprisingly, the developed North American and West European markets were highlighted as important regions. North America is slowly becoming more open to private sector involvement in infrastructure projects, with many investors intending to target such opportunities in the future. Asia was also a popular choice, with 19% of respondents highlighting the importance of Asian infrastructure development. This shows the increasing signifi cance of emerging market infrastructure as the need for development in these regions grows, which is also refl ected in the signifi cant number of Asia and Rest of World funds currently raising capital.Remember that you can find this research report and many others in the INFRASTRUCTURE/PPP REPORTS DATABASE and don't forget to visit the PPP BOOKSTORE.Follow me on twitter.Have a good day!