About civil engineering firms and acquisitions. AECOM, Mott Macdonald and Atkins

Date

August 22, 2010

Subscribe to our newsletter and get the latest news and business opportunities in your inbox

I've been watching a lot of movements in the civil engineering design industry lately. AECOM is involved in 3 of them, they have acquired Davis Langdon, INOCSA and Tritech Rail .The last two reflect a good strategy to grow in the high speed rail industry, specially important to get a good portion of the american high speed rail cake. Actually the U.S. design market is estimated to be worth $80 billion.

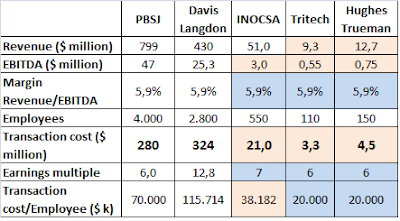

I've been watching a lot of movements in the civil engineering design industry lately. AECOM is involved in 3 of them, they have acquired Davis Langdon, INOCSA and Tritech Rail .The last two reflect a good strategy to grow in the high speed rail industry, specially important to get a good portion of the american high speed rail cake. Actually the U.S. design market is estimated to be worth $80 billion.Atkins also wanted to grow in the United States and for that they have bought PBSJ. And last but not least, Mott Mcdonald has bought a small engineering firm in Australia called Hughes Trueman.Let me go through each transaction more in detail. Numbers have been announced for the biggest two operations (PBSJ and Davis Langdon) but not for the others. Below I give you the open numbers and in the end of the post I present a detailed study estimating conservatively the value of the other transactions.AECOM's acquisitions:1. Davis Langdon sold to Aecom for £200mDavis Langdon provides cost and project management services, and specialist consultancy services, to clients around the world, with a strong presence in Africa, Australia and New Zealand, Europe, the Middle East and the United States.Davis Langdon's key numbers:

- Number of employees: 2,800

- Gross revenue: US$430 million in 2009

- Transaction cost: US$324 million.

- Number of employees: +100

- Number of employees: 550

- Gross revenue: $51 million in 2009

- Number of employees: 150

- Number of employees: 4,000

- Gross revenue: US$799 million in 2009

- EBITDA: $47 million

- Net income: $23.6 million

- Transaction cost: US$280 million.

- Revenue/EBITDA: 5.9 %

- Earnings multiple: 6

- Revenue/EBITDA used: 5.9 % (revenue in 2009: $51 million)--> EBITDA = around $3 million.

- Earnings multiple used: 7 (INOCSA has a very strong presence in Spain and is also in eastern Europe and Latin America)

- VALUE: $23 million

- PBSJ: 70,000

- Davis Langdon: 115,714

- INOCSA: 38,182

- Titech Rail: 20,000 (estimated)

- Hughes Trueman: 20,000 (estimated)

- Revenue/EBITDA used: 5.9 %

- Earnings multiple used: 6 (they are local businesses like PBSJ)

- Hughes Trueman: $4.5 million

- Tritech Rail: $3.3 million